For your convenience our ATM dispenses $5 and $20 bills

with a $1.00 service fee for non-Lexington Ave FCU cards

Please call us at (800) 309-6470 if you have any questions or concerns

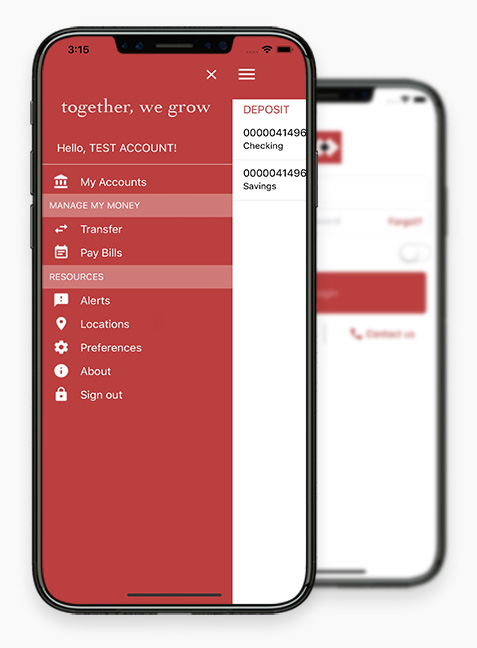

LEXFCU@HOME is a mobile banking solution that enables Credit Union Members to use their iPhone or iPad to initiate routine transactions and conduct research anytime, from anywhere. Customers can view account balances and transaction history, view account alerts, and initiate account transfers.

LEXFCU@HOME supports all account types including:

Lexington Federal Credit Union is a not-for-profit cooperative financial institution founded by employees of Rochester Products in 1959. Lexington FCU is now affiliated with many of the area businesses and continues to add new companies. We also serve people who live, work, worship, attend school, etc. in the City of Rochester.

Call or stop in to our branch to become a member today!

Toll Free: (800) 309-6470

Telephone Banking: (844) 492-8036

Local: (585) 254-4543